KIELTYKA GLADKOWSKI IS EXPANDING ITS TEAM FOR PROTECTION OF FOREIGN CREDITORS OF POLISH COMPANIES IN THE M&A PROCEDURES FOR A) “SHIPPING” THE DEBTS OF A DIVIDED COMPANY TO ANOTHER COMPANY INTENDED FOR BANKRUPTCY AND B) IN CASES OF CREATING A PROFIT CENTER AND A LOSS CENTER. EXAMPLE VALUE 2 MILLION / 10 MILLION DOLLARS

Publication date: July 23, 2024

For effective protection of foreign creditors in Polish jurisdiction, our law firm combines the experience of:

1/ the practices of lawyers and litigators who can predict the effects of M&A as a tool for the attempt to remove assets in the face of possible enforcement;

2/ OSINT analysts and private investigators who, using various methods of analyzing metadata, are able to track crypto transactions and information traffic in the Internet, also from the level of DEEP and DARK WEB, and are able to track the real value of the assets of the Polish company.

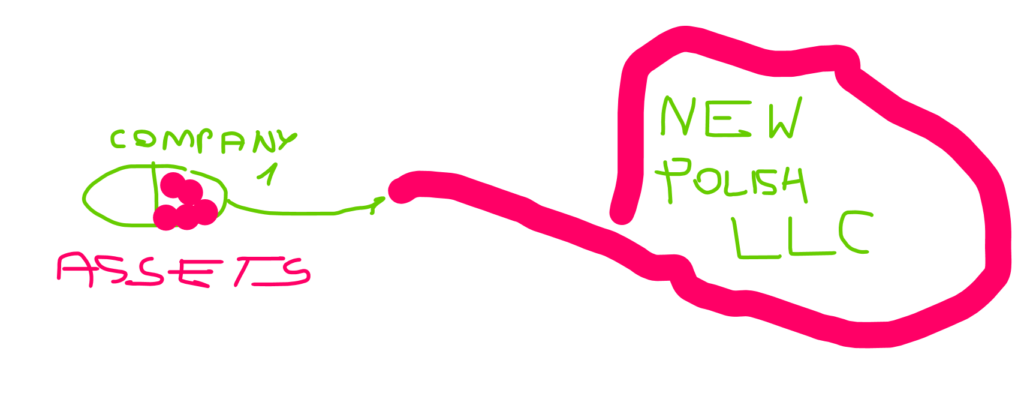

KIELTYKA GLADKOWSKI KG LEGAL is expanding its team for an increasing number of foreign clients who need support in the Polish jurisdiction in securing their interests in a situation when a Polish contractor undergoes the procedure of separating its assets to a nolish company. One example of the support provided by KIELTYKA GLADKOWSKI in the Polish jurisdiction is the case with the value of USD 2 million / USD 10 million in the cross-border entertainment industry, in which we protect a foreign company against a debtor that is in the process of dividing its assets and transferring the assets to a new company.

From the perspective of a foreign creditor with whom the Polish entity does not want to voluntarily settle accounts and leaves open debts, business intentions such as establishing a new company and separating its assets to transfer them to the new company should always be analyzed from the level of the threat to debt solvency in the future.

Polish law indicates that M&A procedures have the potential to be a tool for “runaway procedure” with corporate assets:

- “removing” the debts of the divided company to another company intended for bankruptcy;

- the case of creating a profit center and a loss center.

IN SUCH CASE, liability for the liabilities of the company being divided is limited to the value of the net assets allocated in the plan of division to each acquiring company or company newly established in connection with the division.