Green Power Purchase Agreements – Polish and global perspective

Publication date: April 11, 2023

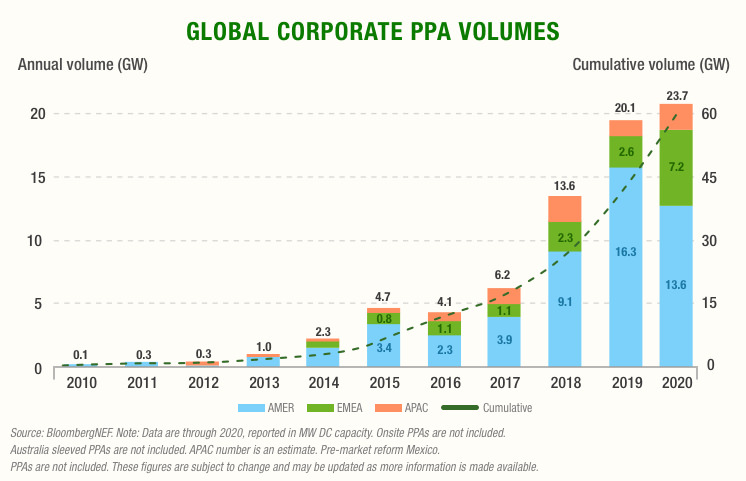

With the current energy crisis that many European countries are suffering, all the players, states, companies and individuals, are searching for new sources of energy at lower costs. At the same time, sustainability and the environmental compromise are becoming one of the axis of corporate activity focusing in achieving neutral-emission goals. In this context, it is worth discussing Power Purchase Agreements (PPAs) which are understood as long-term contracts under which a business agrees to purchase electricity directly from a renewable energy generator. This type of agreement originated over a decade ago in the United States and, since then, these contracts had grown exponentially from a 0.1 GW in 2010 to 23.7 GW in 2020 and had spread across all the continents.

Normally, these operations are interesting for companies requiring large amounts of electricity like in telecommunications, IT servers, industry, so the agreement is between a renewable developer and a consumer. Nevertheless, it also can be made between a developer and a supplier who then resells the energy. The PPA allows a renewable developer to make an investment decision using the criteria of profitability versus risk and/or achieve the funding necessary to execute the project.

Benefices of a PPA

For customers

- PPAs ensure a fixed energy price over the long term, a great benefit in the face of market volatility.

- Allow to achieve a very competitive energy price.

- Enable to plant a cost structure over the long term.

- Green PPA contracts help companies meet their sustainability goals.

- It makes possible to save investment and maintenance costs.

- A PPA secures a reliable electricity supply.

For developers and investors

- Enables the financing of their renewable project by lenders.

- Reduces risks by efficiently allocating them among the contractual parties.

- Offers revenue certainty, as an amount of energy has been sold in advance at an agreed price.

- Allows for the claim of their contribution to the renewable industry.

Types of PPA

- On-site PPA: is a contract for the supply of energy from an ad hoc (made for this purpose) renewable energy plant, normally photovoltaic, located on the customer’s property and connected to its internal network. The developer makes the investment and designs, installs, operates and maintains the plant. The energy generated by the plant is electricity no longer demanded from the grid, so the developer offers the customer this energy at a more competitive price.

- Off-site PPA: is a contract associated with a utility-scale wind farm or photovoltaic plant connected to the transmission or distribution network of the country’s electricity system to take energy from its point of origin to the consumption point.

Off-site focusing on the point of delivery of the energy

- Virtual PPA: The customer negotiates directly with a renewable energy developer to agree on the price of energy (PPA price). In addition, he buys electricity from his preferred energy retailer. At the end of the month, the energy retailer sends the customer a bill for his physical energy consumption. He also receives a detailed breakdown from the developer showing the result of the adjustment for the difference between the spot price and the agreed PPA price. In addition, the developer will transfer the guarantees of origin generated by the installation to the end customer.

It allows a company to buy renewable energy virtually. There is no need to own the title of physical energy. This enables companies to focus on their “green impact”, such as corporates, to receive renewable attributes without owning the asset.

- Physical PPA: The developer sells the renewable energy to an end customer through an energy retailer, which supplies the energy from the renewable asset. Any shortfall is supplied from the retailer’s generation portfolio. At the end of the month, the customer receives a single bill for all its consumption, either from the renewable installation under the PPA or at the spot price.

- Sleeved PPA: In markets where the renewable developer does not have a retailing licence and the customer wants a physical PPA, an agreement with a local retailer can be reached to transfer the conditions of the PPA signed between the client and the renewable developer to the customer.

Off-site PPAs on how the energy is delivered

- As-generated PPA: The customer consumes the gross generation from the plant. This is the most competitive product when it comes to price. However, it is also the riskiest product for the customer as generation from renewable sources is not predictable.

- Baseload PPA: The renewable developer converts the gross generation from the plant into a base load. This is the most common product among customers, as there is an interesting balance between cost and risk. However, it cannot be always made.

- As-consumed PPA: The renewable developer converts the gross generation into a curve which tries to mirror the customer consumption curve.

Green PPAs in the European Union

The European Institutions are advising Member States to simplify their frameworks regulations in renewable energy projects through facilitating green power purchase agreements. Some EU countries regulations can be an obstacle to renewable energy projects. For this reason, the Renewable Energy Directive was made to impose on the EU countries to make changes in their laws.

Today, in the European Union, we are within the framework of the EU REPowerEU and the EU targets to promote the energy transition, so many measures are being taken to encourage renewable energy sources. Some of them are focused on PPAs but without much legislative implication, there are only some recommendations from the Commission and some guidance for Member States on how to accelerate the granting of permits, unlike other measures that have taken the form of a Directive.

The recommendations are focused on faster and shorter procedures; facilitating citizens and community participation; improving internal coordination; clear and digitalised procedures; sufficient human resources and skills; better identification and planning of locations for projects; easier grid connection; innovative projects; facilitating power purchase agreements; and monitoring, reporting and reviewing.

Basically, the Commission recommend Member States to swiftly remove any unjustified administrative or market barriers to corporate purchase agreements of renewable energy, especially for small and medium-sized companies. Member States also should design, schedule and implement support schemes – and guarantees of origin – in such a way that they are compatible with, complement and enable corporate purchase agreements of renewable energy.

Green PPAs in Poland

As well as the rest of its European fellow countries, Poland had seen an increasing interest in PPAs concerning purchasing electricity from renewable power plants. Previously, in the country, there were two simultaneously operating main models in place to support enterprises on generating green electricity: the green certificates system and the auction model intended to replace the green certificate system.

Renewable power plants that started feeding power into the grid before the end of June 2016 receive support in the form of green certificates whose price has fluctuated sharply in recent years. Project developers who did not manage to complete their projects before the end of June 2016 must compete for support in energy auctions. Under the auction system, bidders specify the amount of energy they wish to offer for sale during the auction and determine the purchase price, which may not exceed the reference price set by the State. Bidders who are awarded contracts in the framework of the auction sell the energy for the price achieved during the auction, the pay as bid (plants up to 500 kWp), or sell the electricity on the market and are reimbursed the price equal to the difference between the market price and the auction price. Regardless of the support model, the support period is 15 years from the date on which the power plant in question starts producing energy.

However, with recent energy crisis alongside the increasing popularity of PPAs in the territory made that the legislator presented a draft amendment to the act on renewable energy sources last year. This amendment intends to consolidate the PPAs in the Polish legal system. This provides PPAs with a more stable and secure character for the parties. However, it also brings with it a number of obligations. For example, the obligation to inform the President of the Energy Regulatory Office about the conclusion of such agreements and to include information about the parties, the quantity and price of the energy, the type of renewable source and the duration of the deal. This obligation has retroactive effect. Another important change would be the possibility of creating an energy production plant with a direct connection to the consumer without the need to connect to the national grid. Right now, with the in force legislation, PPAs are obliged to be connected with the national grid. This probably incentives big companies with large consumption or electricity to make a PPA to supply its big demand of energy. It is also envisaged that the provision of energy certificates of origin will only be made available to the parties to the agreement.

Currently, the Polish energy market is dominated by coal-based production, with around 70-80% of the energy generated in the country as a whole. While it is not as dependent on Russian gas as other EU countries, it is dependent on other fossil fuels such as oil and, to a lesser extent, coal. Not surprisingly, it is suffering from large increases in electricity prices like the rest of Europe, with the exception of a few cases such as the Iberian states. Alongside European initiatives and support, the Polish administration is exploring ways to diversify its energy sources and accelerate the decarbonisation of the country’s electricity supply. Through the PPAs, it is possible to increase the production of renewable energy as well as to stimulate an incipient industrial sector. Every effort is too little to achieve these goals. PPAs are a way to reduce these costs through increased private participation in these projects.

Some examples of actuals PPAs in Poland can be found on the supply of energy to the Mercedes-Benz’s engine factories in Jawor and the ten years long PPA with Asahis Polish breweries factories with the installation of a wind farm to cover the 100% of Asahis demands.

In 2020, the contracted capacity under corporate energy purchase agreements (Corporate PPAs) in Europe increased by nearly 60% compared to 2019. The popularity of corporate green energy purchase agreements (PPAs) is growing year by year. In total, 51 contracts of this type were signed in Europe in 2020, and the total capacity of energy contracted under the PPA has already reached nearly 4 GW – an increase of 60% compared to the previous year.

PPAs in Poland are still rare, and there are a number of difficulties on the way to their dissemination. Entities interested in purchasing energy under the Corporate PPAs point out that the main obstacle is unstable legislation. It is also indicated that recipients are discouraged from switching to PPA by the national rules for granting compensation for energy-intensive sectors in the case of contracting energy from conventional sources. On their basis, these entities receive a subsidy for the purchase of energy, which becomes more expensive due to the increase in the prices of CO2 emission allowances, but the support does not go to energy generated from renewable energy sources. Another barrier is the inability to set energy prices on the Polish Power Exchange in the long term, because the longest listed instruments go back three years. This makes it difficult to determine a long-term price perspective for the contract. The companies wishing to protect themselves through PPAs against long-term fluctuations in energy prices must meet many requirements, often inadequate to the size of their operations – e.g. obtaining appropriate concessions in the area of electricity. In the current legal status, the conclusion of an PPA requires the participation of a trading company in it, or the need to use the technical infrastructure belonging to the network of distribution operators. In both cases, this involves high costs on the recipient’s side.

One of the basic types of Corporate PPA is a contract based on a separate direct line between the electricity producer and consumer, outside the existing network infrastructure of the local distribution network operator. Bearing in mind Polish legal regulations regarding the use of a direct line, the development of this type of contracts is currently impossible in most cases without the inclusion of a distribution network operator.

There is therefore proposed, among other things, creation of the so-called closed distribution systems, which would exempt companies from certain statutory requirements disproportionate to the type and scale of their activity in the field of electricity generation and distribution.