CORPORATE GOVERNANCE PRINCIPLES FOR SUPERVISED INSTITUTIONS – practical analysis of the document developed by the Polish Financial Supervision Authority

Publication date: November 29, 2024

The document “Principles of Corporate Governance for Supervised Institutions” developed by the Polish Financial Supervision Authority (KNF) is a key set of principles regulating the functioning of supervised institutions, such as banks, pension funds, insurers and other financial market entities. Adopted by the KNF resolution of 22 July 2014, it has been in force since 1 January 2015 and serves as a guide in ensuring transparency, stability and ethics of the operations of entities on the financial market.

The legal basis of the “Principles of Corporate Governance for Supervised Institutions” results from both Polish acts regulating the activity of the financial market, as well as EU and international regulations that establish standards for the operation of financial institutions. The document, adopted by the Polish Financial Supervision Authority (KNF), is based on legal provisions defining the objectives and competences of this body, in particular the Act of 21 July 2006 on the supervision of the financial market (i.e. Journal of Laws of 2024, item 135). It is under this Act that the KNF was obliged to ensure the proper functioning of the financial market, protect market participants and ensure its stability and transparency. Within the framework of these competences, the Commission may issue recommendations and principles of good practice, which became the basis for the development of the “Principles of Corporate Governance”.

In Polish law, the document also refers to regulations concerning specific sectors of the financial market. An important role here is played by the Act of 29 August 1997 – Banking Law (Journal of Laws of 2024, item 1646), which regulates the functioning of banks, their organizational structure and risk management principles. Similar provisions also apply to investment funds and pension funds, which operate on the basis of separate acts regulating their organization, obligations towards clients and supervision principles.

The “Principles of Corporate Governance” also have their roots in international regulations, especially in EU law. Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (OJ EU L 176, 2013, p. 338, as amended) and Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (OJ EU L 176, 2013, p. 1, as amended), which refer to prudential requirements for financial institutions, introduce detailed guidelines on corporate governance, including risk management, remuneration policy and the organisational structure of credit institutions. It is also worth mentioning the guidelines of the European Banking Authority (EBA), which specify governance standards in the banking sector, and similar regulations developed by the European Insurance and Occupational Pensions Authority (EIOPA) and the European Securities and Markets Authority (ESMA), concerning the insurance sector and the capital market, respectively.

Against the background of these regulations, the Polish “Principles of Corporate Governance” are an adaptation of international standards to national conditions. In addition to sectoral acts, an important legal element is the Act of 15 September 2000 – the Commercial Companies Code (consolidated text: Journal of Laws of 2024, item 18, as amended), which defines the basic principles of functioning of corporate bodies. In turn, regulations such as the Act of 6 March 2018 – Entrepreneurs’ Law (consolidated text: Journal of Laws of 2024, item 236, as amended) provide a general framework for business activity, including compliance with good practice standards in business.

As a result, the “Principles of Corporate Governance” are a document that combines the requirements resulting from national regulations with international regulations, creating a coherent set of principles aimed at increasing transparency, stability and trust in the Polish financial market. The KNF, as the body guarding these values, ensures their effective implementation and compliance in supervised institutions.

1. Introduction

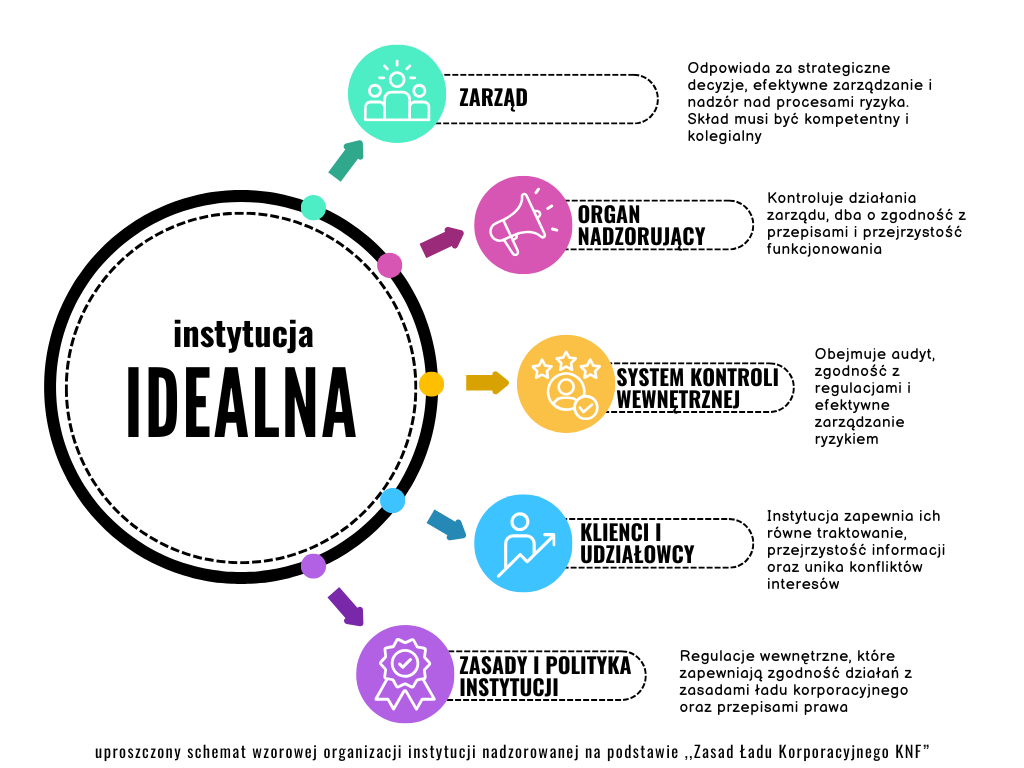

The introduction to the document is an introduction to the scope and purpose of the “Principles of Corporate Governance”. The KNF emphasizes the importance of the principles for building public trust, not only in individual institutions, but in the entire financial market. The document defines the framework for the internal and external relations of supervised institutions, including their relations with clients, shareholders and regulators. It is a set of guidelines on the organization of institutions, internal supervision, risk management, information policy and other key functions. The introduction emphasizes that compliance with these principles is essential for professionalism and responsibility in management, as well as for maintaining the stability of the entire financial sector.

The KNF draws attention to the need for responsible action by both members of statutory bodies and shareholders. Institutions should conduct their business with the utmost care, taking care of the client and providing reliable information about the risks associated with the services offered. It is also necessary to ensure the efficiency and transparency of operations by strengthening internal supervision. These principles not only constitute guidelines for supervised institutions, but also have a programmatic nature, influencing the strategic approach to management in these organizations.

2. Chapter 1: Organization and organizational structure

The first chapter of the document focuses on the requirements for the organization of supervised institutions. It emphasizes the importance of transparency of the organizational structure, which should be adequate to the scale and nature of the activity and allow for the implementation of strategic goals. Each element of the structure – from the headquarters to the local units – should have clearly assigned duties and responsibilities, which eliminates the risk of conflicts of competence.

This chapter also emphasizes internal regulations, which should clearly define the rules of operation, the flow of information and the way of making decisions. Institutions are required to publish basic information about their organizational structure, which increases their transparency. An important element of this chapter is also the introduction of systems for reporting irregularities, which are to protect employees reporting abuse from repression.

3. Chapter 2: Relations with shareholders of the supervised institution

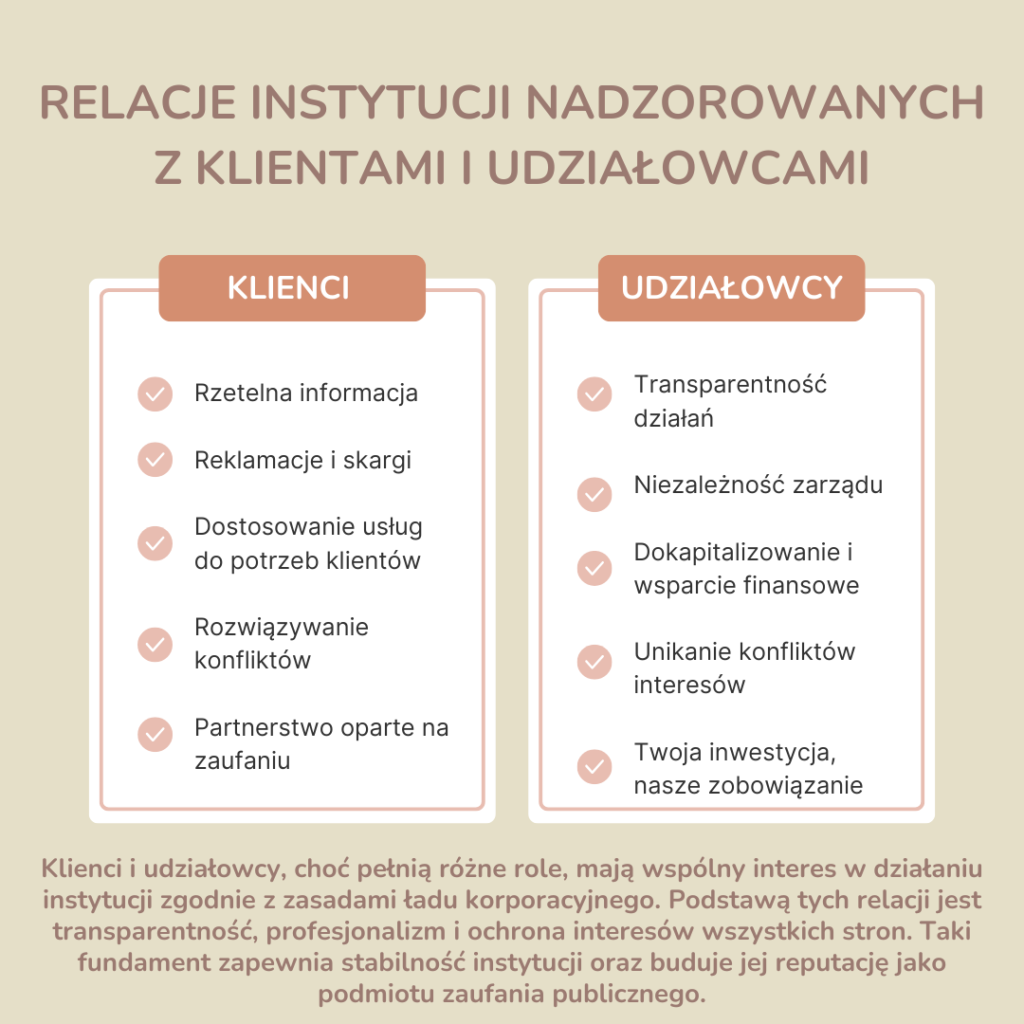

This chapter discusses the relationships of supervised institutions with their shareholders. The key principle is to act in the interests of all shareholders while respecting the interests of clients. The document indicates that shareholders should cooperate in achieving the institution’s goals and demonstrate responsibility for its functioning, including through recapitalization in crisis situations. Institutions are required to provide shareholders with reliable and non-discriminatory information about the actions and decisions taken.

In addition, this chapter introduces rules on related party transactions and conflict of interest management to ensure transparency of activities and avoid situations that could harm the interests of the institution or clients. Shareholders cannot interfere in the activities of the board, and their actions should be subordinated to the interests of the institution.

4. Chapter 3: Governing Body

The third chapter is devoted to the role of the management body in a supervised institution. This body, acting collectively, should have the competences enabling effective management of the institution. The KNF emphasizes that management must be carried out in accordance with the adopted strategy and in a way that guarantees the security of the institution’s operations. Particular attention is paid to the requirements regarding the qualifications of the members of the management board, who must have the appropriate knowledge, experience and skills.

The internal division of responsibilities between board members should be transparent and unambiguous. Rules have also been introduced regarding limiting conflicts of interest and the obligation to fill the board in the event of vacancies. The management body bears full responsibility for decisions related to risk management and internal control.

5. Chapter 4: Supervisory body

This chapter discusses the functions and responsibilities of the supervisory body that supervises the activities of the institution. The members of the supervisory body must demonstrate competences that will allow them to effectively perform supervisory tasks. The principle of regular assessment of the application of corporate governance principles and monitoring of risks related to the activities of the institution is introduced.

The supervisory body should also cooperate with the audit committee, if one exists in the institution, and assess the remuneration policy and other key aspects of the institution’s activities. The document specifies the rules for organizing meetings of the supervisory body, emphasizing their transparency and effectiveness.

6. Chapter 5: Remuneration Policy

The remuneration policy for members of management and supervisory bodies must be transparent and adjusted to the financial situation of the institution. The KNF recommends that remuneration should be linked to the long-term goals of the institution and should not constitute an incentive to take excessive risks. This policy should be regularly assessed by the supervisory body, and the results of these assessments should be made available to shareholders.

7. Chapter 6: Information Policy

Chapter six concerns the principles of communication of supervised institutions with shareholders and clients. The information policy should ensure transparency of activities, reliability and availability of information. The document indicates the need to provide financial reports and other important information in electronic form.

8. Chapters 7–9: Key Systems, Risk Management, and Conflicts of Interest

In the following chapters, the document defines standards for risk management, internal audit and compliance control. Supervised institutions are required to implement effective risk management systems and avoid conflicts of interest. It also indicates the responsibility of management and supervisory bodies for the effectiveness of these systems.

9. Significance for audits in state-owned companies

In the context of audits conducted in State Treasury companies by external companies, the KNF document provides a regulatory framework for assessing their compliance with corporate governance principles. It emphasizes the role of transparency of activities, reliability of reporting and responsibility of management bodies for audit results and introduction of necessary changes.

10. Summary

In summary, the KNF Corporate Governance Principles are a comprehensive guide defining standards of organization, supervision, management and ethics in supervised institutions. Compliance with them is crucial for building trust in the financial market and the stability of its functioning.