Publication date: December 11, 2024

1. Introduction

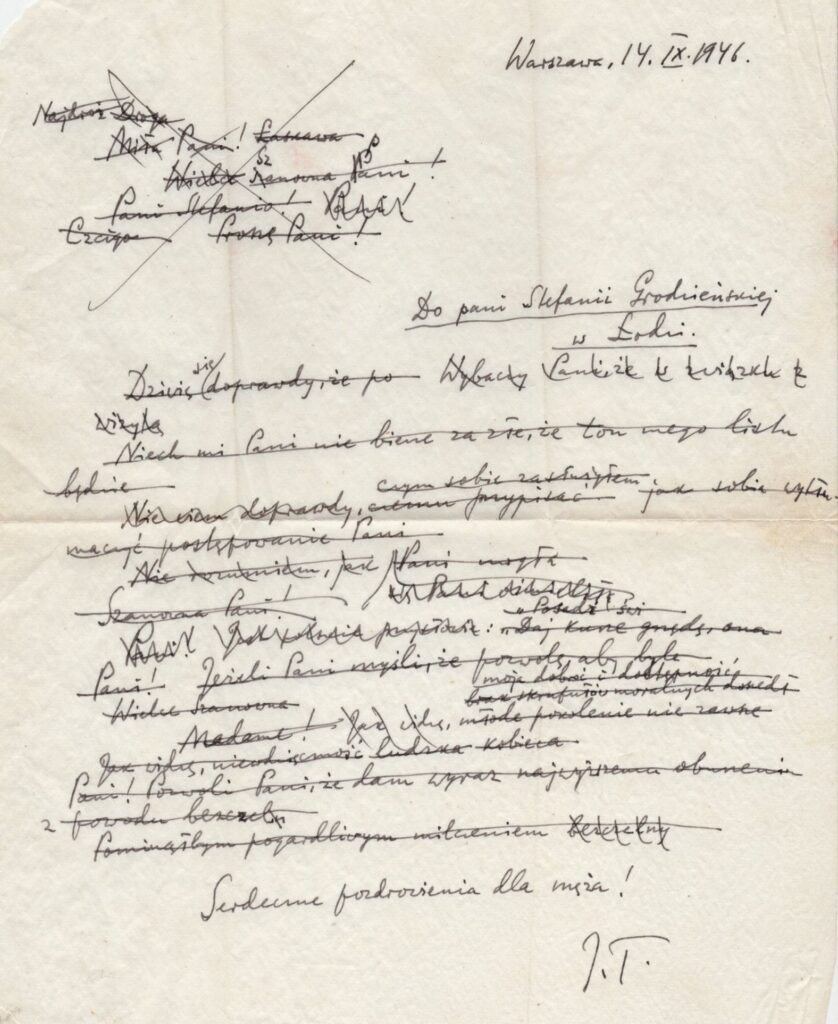

The contemporary market of antique auctions is developing dynamically, which is influenced by online platforms, the growth of collecting and the development of the art market. Online auctions attract collectors and investors, but they also raise legal and tax problems related to the interpretation of VAT and the protection of copyright. Various items – from books to letters and manuscripts – are subject to different regulations, which introduces inconsistency in taxation, e.g. book publications have reduced VAT, and historical documents are taxed differently, which creates difficulties for auctioneers and buyers.

Another problem is fees, such as the hammer fee, added to the price and including VAT, while the lack of consistent rules for its calculation complicates the process. Speculative auctions are also a specific issue, which can lead to tax abuse. The aim of the analysis is to discuss key legal and tax issues on the antique auction market, indicate differences in taxation and challenges related to the hammer fee and speculative auctions, and also propose unification of regulations for greater transparency and consistency of regulations.

More

Publication date: December 11, 2024

Poland, according to current data, is one of the fastest growing economies in Central and Eastern Europe. For years, it has attracted the attention of investors from all over the world. Its strategic geographical location, as well as membership in the European Union and the dynamically developing internal market make it an attractive place to invest your capital. However, the success of the investment depends not only on macroeconomic factors, but also on the legal and tax framework, which is the foundation for conducting business activity.

The aim of this article is to analyse the attractiveness of investing in Poland from a legal and tax perspective. It will discuss key legal aspects, such as the stability of the legal system and investor protection, as well as the tax system, including income taxes and available reliefs and incentives. Particular attention is also paid to the role of Special Economic Zones (SEZ) and the advantages that Poland offers compared to other countries.

More

Publication date: December 10, 2024

1. Introduction

Civil law is a set of norms concerning private law relationships that permeate the economic life of every society. Civil law consists of, on the one hand, absolutely binding norms that apply regardless of the situation, which means that there is no possibility of legally circumventing them, and on the other hand, relatively binding norms, the application of which can be excluded by means of an appropriate contractual clause or provision of a model contract. In addition, there are certain general principles of civil law that give meaning to individual norms.

What happens when these principles conflict? Resolving such a case requires a complex analysis. Recently, such an analysis was carried out by our lawyers’ team in the context of the cap-on liability clause known to Common Law legal systems, which limits ex contractu liability for damages to the amount accepted by the parties to the contract. Is it possible to translate it into a Polish law contract? How does it relate to the principle of freedom of contract and the principles of liability for damages? What does contractual liability look like in Polish law and how far can the parties to the contract go in modifying it? In this entry, we share with you our answer to this question based on the provisions of the Act of 23 April 1964, the Civil Code (Journal of Laws of 2024, item 1061, as amended; hereinafter referred to as the Civil Code or CC) and other legal acts.

More

Publication date: December 10, 2024

The Polish legal system has recently undergone a number of significant changes, the most recent of which concern the Code of Civil Procedure. A few years ago, conducting an online hearing was impossible. Although the regulations allowed videoconferencing, it was limited to connections between courts, mainly used for questioning witnesses. The COVID-19 pandemic has significantly affected these regulations, leading to the introduction of the possibility of remote participation in hearings. Thanks to the amendment of the regulations in March 2020, remote hearings have become a reality, initially as a temporary solution, aimed at counteracting the effects of the pandemic.

Seeing the effectiveness and convenience of remote hearings, the legislator decided to permanently introduce this form to the Code of Civil Procedure. On March 14, 2024, an amendment came into force, which not only consolidates remote hearings as a standard procedure, but also introduces a number of other innovations. The aim of these changes is to streamline and accelerate civil proceedings, so that the justice system is more effective and accessible to citizens and entrepreneurs.

More

Publication date: December 02, 2024

Alternative investment companies are a specific form of investment activity introduced into the Polish legal system within the framework of the provisions on investment funds, and specifically in the context of managing alternative investment funds. These regulations are contained in the Act of 27 May 2004 on investment funds and the Act of 22 July 2005 on the management of alternative investment funds, Journal of Laws 2024.1034. AIICs are therefore a specific form of asset management that creates the possibility of investing in alternative assets, such as real estate, private equity, raw materials or debt, while maintaining high flexibility in terms of investment strategies.

Legal Basis for Alternative Investment Companies

More