Tax Issues regarding Online Auctions – Legal Aspects

Publication date: December 11, 2024

1. Introduction

The contemporary market of antique auctions is developing dynamically, which is influenced by online platforms, the growth of collecting and the development of the art market. Online auctions attract collectors and investors, but they also raise legal and tax problems related to the interpretation of VAT and the protection of copyright. Various items – from books to letters and manuscripts – are subject to different regulations, which introduces inconsistency in taxation, e.g. book publications have reduced VAT, and historical documents are taxed differently, which creates difficulties for auctioneers and buyers.

Another problem is fees, such as the hammer fee, added to the price and including VAT, while the lack of consistent rules for its calculation complicates the process. Speculative auctions are also a specific issue, which can lead to tax abuse. The aim of the analysis is to discuss key legal and tax issues on the antique auction market, indicate differences in taxation and challenges related to the hammer fee and speculative auctions, and also propose unification of regulations for greater transparency and consistency of regulations.

2. Differences between books and documents – impact on VAT and copyright

2.1 Legal Characteristics of Books and Documents

The antiquarian market includes a variety of items that have different legal character. Books, especially those with an ISBN, are usually treated as publications with a specific legal status, which affects their tax classification and copyright protection. Documents such as letters, manuscripts or unique notes may constitute individual works under copyright law, which also affects their tax status and requires different legal interpretations. The legal basis for distinguishing these categories can be found in several acts that treat books as publications and historical documents as potentially unique works differently:

- Civil Code (CC) – Art. 45 of the CC defines things as tangible objects that may be subject to property rights. In the context of the antiquarian market, objects such as books and documents are things that may have individual features that affect their value and legal status.

- Act of 4 February 1994 on Copyright and Related Rights (Journal of Laws of 2022, item 2509, as amended) – Art. 1 on Copyright and Related Rights defines a work as any manifestation of creative activity of an individual nature, which may include both book publications and documents such as letters or manuscripts. Copyright protection affects the legal status and indirectly tax issues related to such objects.

2.2 VAT for books

In the Polish tax system, books with an ISBN (an identification number assigned to each publication, International Standard Book Number) are subject to a reduced VAT rate, which results directly from the provisions of the Act of 11 March 2004 on the tax on goods and services (Journal of Laws of 2024, item 361, as amended) – in accordance with art. 41 sec. 2a and Annex No. 10 to this Act, book publications are subject to a reduced VAT rate, which is currently 5%. This provision applies to books, specialist journals and other publications with an ISBN. Thanks to this, books, both new and antiquarian, can be sold at a lower tax rate, which is beneficial for buyers.

The requirement to have an ISBN is crucial, as it allows for the application of a preferential rate. In the case of books without an ISBN, there may be problems with interpretation, and their sale may be subject to a higher VAT rate. In practice, this means that antiquarian books without an ISBN may be subject to the basic rate, which is 23%.

2.3 VAT on documents and letters

Documents such as letters, manuscripts, and historical documents can have different tax statuses, depending on their legal nature and status as creative works. Unlike books, the sale of documents is not subject to the reduced VAT rate, which can increase their price and make them more difficult to sell.

Art. 43 sec. 1 item 2 of the Act of 11 March 2004 on the Goods and Services Tax (consolidated text: Journal of Laws of 2024, item 361, as amended) exempts from VAT certain supplies of used goods, but this exemption does not apply to collectibles that have unique or artistic value. Therefore, historical documents, such as letters, that may be considered works of individual character, may be taxed at the basic VAT rate.

In the case of collectible documents, such as autographed letters or unique manuscripts, there is a risk of different interpretations of whether the item constitutes a work of artistic value or not. This can lead to inconsistent practices among different auction houses.

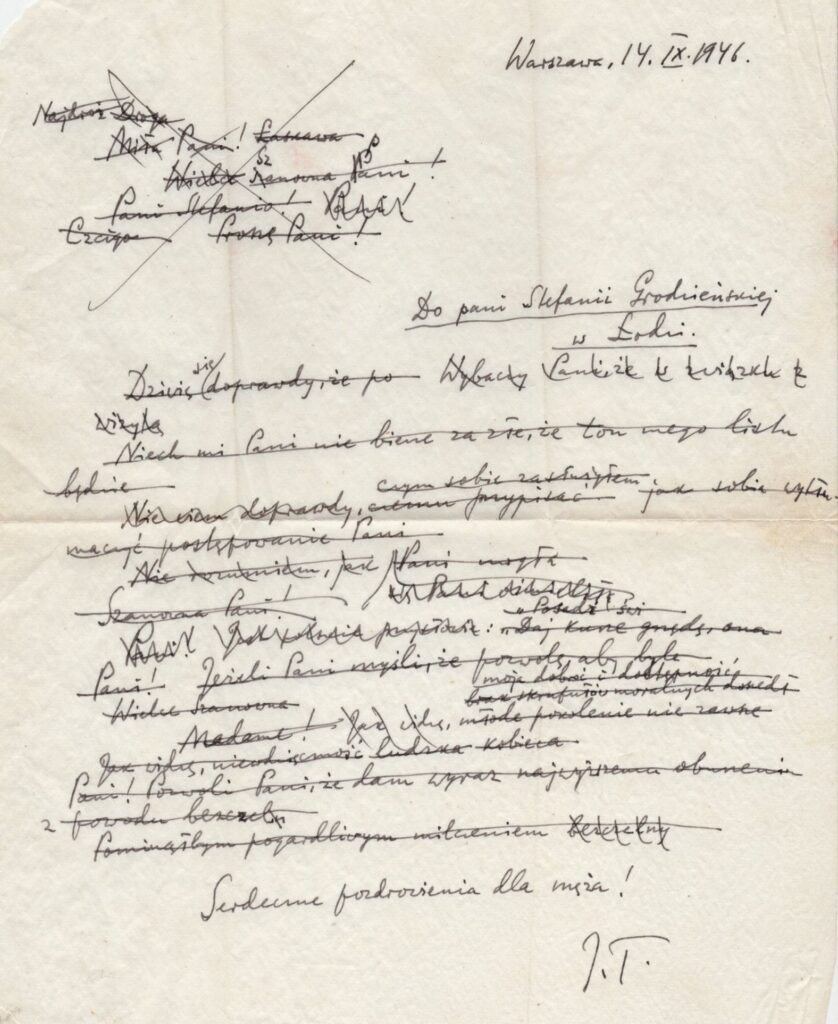

2.4 Auction Examples

To illustrate the differences in the approach to taxing books and documents, examples of antiquarian auctions can be used. For example, a letter from Julian Tuwim addressed to Stefania Grodzieńska was put up for auction[1]. This letter, as a unique manifestation of creativity, is protected by copyright, and its value is higher due to its individual character. Therefore, taxation of such a letter may differ from taxation of a book by the same author with a dedication. A book, even with a dedication, is usually subject to a reduced VAT rate, while a unique letter may be charged the basic tax rate.

3. The Importance of Copyright in the Case of Letters and Dedications

In the case of antique auctions of collectibles such as letters and dedications, copyright protection regulations play a special role, because these items often go beyond the material value of the item itself and can be protected as manifestations of the author’s creativity. The analysis of copyright protection in relation to letters and dedications is important for determining the legal status of these objects, which affects their market value and the legal issues related to their sale.

3.1 Document as a creative contribution

In accordance with the Act of 4 February 1994 on Copyright and Related Rights (Journal of Laws of 2022, item 2509, as amended), any manifestation of creative activity of an individual nature, established in any form, is subject to protection (Article 1, paragraph 1 of the Copyright and Related Rights Act). Letters – especially those of a literary, emotional or artistic nature – may be considered works within the meaning of copyright law, because they constitute a unique creative contribution of the author.

Letters that contain individual thoughts, emotions or are written in a particular style characteristic of the author may be covered by full copyright protection under Copyright and Related Rights Act. An example are the letters of the poet Julian Tuwim, which not only serve as historical documents but also have creative value resulting from personal communication, which makes them treated as works protected by copyright.

According to Art. 36 Copyright and Related Rights Act, copyright protection lasts for 70 years after the death of the author. Therefore, the sale or reproduction of works is associated with the need to take into account copyright protection and respect the rights of heirs. In the case of Julian Tuwim, his works have already passed into the public domain. This means that the copyright has expired, so Tuwim’s letter is no longer protected by copyright. Therefore, there is no need to obtain consent for its sale, publication or reproduction (e.g. in an auction catalogue). The expiry of copyright protection does not affect the VAT rate charged on the sale of such a letter.

As a rule, however, letters require respect for copyright, which means that their listing at an antique auction, publication or reproduction must take place in compliance with the regulations on the protection of these rights. Lack of consent from the heirs or the copyright owner may result in claims for copyright infringement, including claims for remuneration or a ban on publication.

3.2 Dedications and Copyright

Dedications in books, although often personal in nature, usually do not change the legal status of the book as a work subject to copyright protection. The dedication is treated as an additional element enriching the material value of the book, but rarely in itself constitutes a separate work protected by copyright. This is important because dedications do not affect the copyright protection of the book, and are not treated as a separate work requiring separate consent for reproduction or publication.

Authors’ dedications on copies of books are often short, personal messages and do not meet the criteria for a creative work, unless they demonstrate individual and original features (Article 1, Section 1 of the Copyright and Related Rights Act). For example, a simple dedication “For Stefania with regards, Julian Tuwim” does not meet the criteria for a work, because it lacks a creative character, which means that it is treated solely as a collector’s item that increases the market value of the copy.

Unlike dedications, letters written by the author may contain personal thoughts and emotions that make them works. The dedication is therefore an valorizing addition, not a subject of protection under Copyright and Related Rights Act. As with letters, the copyright protection period of the dedication depends on the protection period of the book itself, but the dedication itself does not entail additional copyright obligations.

3.3 Practical example: Julian Tuwim’s letter

The example of selling a Tuwim letter, such as the aforementioned letter to Stefania Grodzieńska, is an excellent illustration for analyzing copyright issues and differences in the nature of legal protection of letters and dedications. Unlike books with a signature or a short dedication, such letters have value not only because of the author, but also as works of an individual character, being a manifestation of creative activity.

Tuwim’s letter not only documents the author’s personal emotions and views, but also reflects his literary style, which makes it more legally complicated than a book with a dedication. In this case, it is necessary to take into account the provisions of the Copyright and Related Rights Act, which protect both the creative and historical value of the letter, as an object with the status of a work.

In the case of antique auctions, the sale of such a letter is associated with the need to respect the copyright to the content of the letter itself, i.e. to obtain the consent of the owner of the rights. Without such consent, the publication or reproduction of the letter (e.g. in an auction catalog) may be considered a violation of the Copyright and Related Rights Act regulations, which may result in legal sanctions and claims for damages.

4. The “hammer” issue – impact on taxation

4.1 Definition of “hammer”

The hammer fee is an additional cost that the buyer of an item must pay during an auction. It is usually stated as a percentage of the final price of the auctioned item and is added to the sale price. The purpose of the hammer fee is to cover the costs of organizing the auction and the auction house’s commission. This fee increases the total cost of purchasing the item, which is a consideration for both the buyer and seller.

4.2 VAT in the context of the “hammer”

According to Polish law, the “hammer” fee is subject to VAT. Art. 5 sec. 1 item 1 of the Act of 11 March 2004 on the tax on goods and services (consolidated text: Journal of Laws of 2024, item 361, as amended) specifies that the tax applies to the paid delivery of goods and the paid provision of services in the territory of the country. In this case, the “hammer” fee is treated as a service provided by the auction house to the buyer. The VAT rate for this fee is usually 23%, which additionally increases the total cost borne by the buyer.

The lack of uniform rules for taxing this fee may lead to differences in the way it is calculated, and therefore to confusion for market participants. Standardization of taxation of the “hammer” fee could introduce transparency, simplifying tax settlements and enabling better comparison of auction costs between different auction houses.

4.3 The importance of transparency

Unifying the approach to the “hammer” fee and introducing the obligation to calculate VAT uniformly could increase the transparency of the auction market. For buyers, clear information about additional costs allows them to better assess the total expense and avoid surprises with a higher cost than that resulting from the price of the auctioned item. Such transparency is crucial from the point of view of security and trust in the antique auction market, which attracts both collectors and investors.

5. Speculative auctions and taxation

5.1 The nature of speculative auctions

Speculative auctions are a specific type of auction in which the items being auctioned are not necessarily intended to be sold. The goal is rather to check their market value or to generate interest from potential buyers. These auctions can be organized by owners of items who do not intend to sell them, but only want to assess the potential market value of collectibles or art objects, for example based on the amounts offered. Such transactions, although at first glance they may resemble standard auctions, differ from them in terms of the intention and approach to the issue of sale.

5.2 Tax Issues Related to Speculative Auctions

Speculative auctions generate numerous tax challenges due to the possibility of being misclassified as genuine transactions. The main difficulty is assessing whether in a given case there has been an actual sale or merely an action to establish market value. Misclassifying such an auction as a sale transaction can lead to unjustified assessment of income tax or VAT, which burdens both sellers and auction houses.

In the Polish tax system, the basis for taxation of a transaction is the actual sale of goods or provision of services. In situations where a speculative auction is treated as an actual transaction, the seller may be required to pay income tax on the value of the item, as well as VAT, which in practice introduces additional financial burdens.

Art. 5 sec. 1 item 1 of the Act of 11 March 2004 on the Goods and Services Tax (consolidated text: Journal of Laws of 2024, item 361, as amended) and Art. 10 sec. 1 of the Act of 26 July 1991 on the Personal Income Tax (consolidated text: Journal of Laws of 2024, item 226, as amended) indicate that transactions involving the sale of movable goods and the provision of services are subject to taxation. However, in the case of speculative auctions, the lack of intention to sell indicates the need to define these transactions as not meeting the criteria for classifying them for taxation, which requires greater interpretative and regulatory precision.

5.3 Possible adjustments

Given the growing popularity of speculative auctions, there is a need for clearer regulation and control of such transactions. The regulations could introduce clear criteria for classifying auctions as speculative sales or genuine commercial transactions, which would help avoid misunderstandings and abuses. It is also possible to develop detailed guidelines for auction houses, which would specify procedures for identifying the intention to sell and for recording speculative auctions, which would minimize the risk of tax misclassification.

The introduction of these regulations would allow for better protection of the interests of both buyers and sellers, and would also increase transparency in the auction market. Additionally, these changes could help reduce the abuse and market manipulation that sometimes accompanies speculative auctions.

6. Summary

6.1 Conclusions

The analysis of the antiquarian auction market, especially in the context of taxation and copyright protection, highlights significant problems resulting from the lack of uniform regulations. In light of the issues raised, it becomes clear that the diversity of items offered at auctions – from books with ISBN numbers, through historical documents, to unique letters with autographs – requires a coherent approach from both auction organizers and legislators. Key challenges include:

- Non-uniform approach to VAT, especially when selling items of different legal nature, which may lead to interpretation difficulties.

- Problems with calculating the “hammer” fee and its impact on the total cost to buyers, which result from the lack of standard taxation rules.

- The need for clear regulations for speculative auctions, which can currently be misinterpreted from a tax perspective, creating additional complications and potential financial burdens for market participants.

6.2. Proposed solutions

In order to ensure greater transparency and uniformity in the antique auction market, it is advisable to introduce several legal and procedural solutions:

- A clear distinction between categories of items sold at auction – for example books, historical documents and letters – which would enable VAT rates to be clearly established. The introduction of separate taxation rules for individual categories of items could significantly improve the market situation.

- Unification of the rules for calculating the “hammer” fee so that the cost of this fee and the method of its taxation are unambiguous for all auction participants, which would positively impact the transparency of transactions.

- Strengthening controls over speculative auctions by introducing regulations that clearly define when a transaction is considered an actual sale and when it is merely an attempt at pricing. Reducing the possibility of market manipulation would increase the security of transactions for market participants.

The adoption of these proposals would reduce ambiguities and potential abuses in the antique auction market, contributing to a more uniform and transparent system of taxation and protection of copyrights. These regulations could also increase trust in online auctions, which is particularly important in the context of their growing popularity and global reach.

[1] https://onebid.pl/pl/dokumenty-tuwim-julian-tajemniczy-list-do-stefanii-grodzienskiej-1946/2117538