IP Box in Poland: opportunities, controversies and planned changes in tax regulations

Publication date: November 28, 2024

Introduction

The IP Box (Innovation Box) relief is one of the tools introduced to the Polish tax system to support research, development and innovation activities. Since 2019, Polish entrepreneurs, including individuals conducting business activities, can benefit from a preferential tax rate of 5% for income obtained from qualified intellectual property rights. This solution is of particular importance for the dynamically developing IT industry, in which the work of programmers often generates qualified income, for example from copyrights to software.

However, the IP Box relief raises many interpretation controversies, especially in relation to the definition of qualified intellectual property rights and documentation obligations. In practice, taxpayers often encounter difficulties in separating income covered by the relief and meeting the requirements for maintaining detailed records. An additional challenge is the application of the relief in the context of international cooperation, especially in the case of Polish programmers implementing contracts with foreign companies.

The aim of this article is to present the structure of the IP Box relief in the Polish legal system, to analyse current problems related to its application and to discuss planned legislative changes. Practical issues will also be addressed, such as the significance of the relief for the Polish economy and its role in increasing the competitiveness of the IT sector in the international arena. In particular, we will draw attention to issues that raise interpretation doubts and to the potential consequences for taxpayers resulting from the proposed changes to the regulations.

1. The structure of the IP Box relief in the Polish legal system

1.1 Legal Basis

The IP Box relief was introduced into Polish tax law to support innovation and R&D activities. Its legal basis can be found in the following acts:

- Act of 26 July 1991 on personal income tax (consolidated text: Journal of Laws of 2024, item 226, as amended)

Article 30ca of this Act regulates the principles of applying the IP Box relief by individuals conducting business activity. The Act specifies that a preferential tax rate of 5% may be applied to income obtained from qualified intellectual property rights that have been created, developed or improved as part of research and development activities.

- The Act of 15 February 1992 on Corporate Income Tax (Journal of Laws of 2023, item 2805, as amended)

Article 24d of this Act introduces similar regulations for legal persons. The provisions define qualified intellectual property rights (IP) and impose the obligation to maintain detailed accounting records. These records should enable the separation of income from such rights.

- Tax explanations of 15 July 2019 as the basis for the registration requirements for IP Box

The tax explanations issued by the Ministry of Finance on 15 July 2019 are a key document explaining the practical aspects of applying the IP Box relief. This document contains detailed guidelines on maintaining records that enable preferential taxation of income from qualified intellectual property rights (qualified IP).

1.2 Definitions of key terms

- Qualified Intellectual Property Rights (QI)

In accordance with Article 30ca section 2 of the Personal Income Tax Act and Article 24d section 2 of the Corporate Income Tax Act, qualified IP includes, among others:

- patents,

- protection rights for utility models,

- rights from registration of industrial designs,

- copyright to computer programs,

- additional protective rights for medicinal products and plant protection products.

The 2019 tax clarifications explained that qualifying IP must be created, developed or improved through research and development (R&D) activities. This excludes rights acquired in a fully finished form from related entities.

- Qualified income and how to calculate it

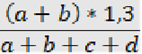

The preferential 5% tax rate may be applied only to income attributed to qualified IP. This income is calculated based on the nexus indicator, which describes the proportion of R&D costs to the total costs related to a given right (Article 30ca, paragraph 4 of the PIT Act and Article 24d, paragraph 4 of the CIT Act):

Where:

- A – costs of R&D activities incurred by the taxpayer,

- B – costs of acquiring R&D results from unrelated entities,

- C – costs of acquiring R&D results from related entities,

- D – costs of acquiring qualified IP.

1.3 Conditions for using the relief

Maintaining separate accounting records is one of the key requirements for taxpayers who want to take advantage of the IP Box relief. This documentation must enable the separation of income derived from qualified intellectual property rights (IP). It includes both revenues and costs related to the production or development of qualified IP, which allows for precise calculation of the nexus indicator.

However, what is also worth mentioning, in the judgment of the Regional Administrative Court in Gliwice of 30 July 2024 (I SA/Gl 1290/23 – Judgment of the Regional Administrative Court in Gliwice), the court repealed the interpretation in which the tax authority found that the lack of current record keeping prevents the use of the IP Box relief. The court indicated that the regulations only require the keeping of separate records in a way that allows for the correct determination of income and preparation of a tax return at the end of the year. Therefore, the records do not have to be kept on an ongoing basis, provided that they comply with the requirements of the Act.

In addition to maintaining separate tax records, in accordance with Article 30ca paragraph 3 of the Personal Income Tax Act and Article 24d paragraph 3 of the Corporate Income Tax Act, the taxpayer’s activity must be organized, continuous and aimed at creating, developing or improving qualified IP. Tax explanations emphasize that correct and detailed documentation of research and development activities is a key condition for applying a preferential tax rate.

2. Planned changes to IP Box regulations

2.1 Legislative proposals

The IP Box relief, as a relatively new tool for supporting innovation, is constantly monitored by the legislator in order to improve it. Although detailed projects of changes in the regulations have not yet been announced, analyses and expert opinions indicate several areas that may be subject to modification:

1. Sealing the relief

- Introduction of additional documentation requirements that aim to limit the possibility of abuse, such as attributing income to qualified IPs without proper justification.

- Possibility of specifying in more detail the rules for separating income from qualified IP in order to unify the practice of applying the regulations by taxpayers.

2. Changes in the nexus indicator

The current nexus indicator is based on the proportionality of R&D costs. Changes are possible to take into account more precisely the expenditure incurred on innovation activities in different business models.

3. Expanding or narrowing the catalogue of qualified IPs

In the future, the catalogue of intellectual property rights covered by the IP Box may be expanded to include new forms of IP, such as protective rights to new technologies, or narrowed to eliminate certain categories that raise doubts about interpretation.

4. Requirement to employ at least three people

The Ministry of Finance has announced the possibility of introducing significant changes to the regulations concerning the IP Box relief, which results from observations of its abuse. In particular, one of the proposed solutions is to introduce a requirement for taxpayers using the relief to employ at least three people. As emphasized by Deputy Minister of Finance, this would limit situations in which the IP Box is used by individuals running a sole proprietorship without a real contribution to increasing the level of innovation in enterprises.

This change, although not yet fully processed, is controversial in the expert community. It is indicated that the employment requirement will not necessarily increase innovation, but will only limit the availability of relief for micro-entrepreneurs, who are the main beneficiaries of IP Box in the IT industry.

2.2 Purpose of the changes

The main objective of the planned changes is to improve the effectiveness of the IP Box relief and its compliance with international standards, such as the OECD guidelines on counteracting harmful tax practices (e.g. as part of the BEPS – Base Erosion and Profit Shifting activities).

1. Improving the application of relief

The changes are intended to simplify procedures related to maintaining records and documenting income from qualified IP. This will make it easier for taxpayers, especially small and medium-sized enterprises, to take advantage of the preferences.

2. Limiting abuse

The planned changes may introduce more stringent requirements to prevent artificially assigning income to eligible IP or declaring costs that are not actually related to R&D activities. The 2019 clarifications emphasized that such a practice would be contrary to the purpose of the relief.

The main goal of the announced changes is therefore to limit the abuse of the IP Box relief by people who use it solely to reduce their tax liabilities, without actually carrying out research and development activities. The Ministry of Finance also points to the need for greater transparency in the application of the relief and strengthening control over its use.

However, experts suggest that a better solution would be to focus on improving the quality of tax interpretations and more effective verification of the business activity conducted. Introducing the requirement to employ three people may not actually translate into increased innovation, but only make access to the relief more difficult.

2.3 Impact on taxpayers

The announced changes may have a significant impact on taxpayers, especially in the IT industry. For the IT sector, the introduction of the requirement to employ three people could reduce the availability of the relief for sole proprietorships, which constitute the majority of IP Box beneficiaries. At the same time, increased inspections by tax authorities, such as verification of the nature of B2B contracts and detailed examination of documentation, may be associated with a greater risk of challenging the application of the relief.

In the case of other sectors, the possibility of tightening regulations and increasing record-keeping requirements may discourage non-IT companies from using the relief, especially if it is difficult to separate income from eligible IP.

3. Risk of negative consequences

Too stringent changes to the regulations may limit the availability of the IP Box relief, which would weaken its attractiveness compared to similar mechanisms in other European Union countries. Poland must compete with France and the Netherlands, among others, which offer preferential tax rates for innovative activities.

3. Controversies and interpretational doubts surrounding the IP Box

3.1 Interpretation problems

Despite the clearly defined purpose of the IP Box relief, which is to support innovation, many provisions raise interpretational doubts. In practice, taxpayers and tax advisors encounter difficulties in applying the regulations, which can lead to disputes with tax authorities.

1. The lack of clarity in the definition of qualified rights

One of the most frequently raised issues is determining which intellectual property rights meet the conditions of qualified IP. Although art. 30ca sec. 2 of the Personal Income Tax Act of 26 July 1991 (consolidated text: Journal of Laws of 2024, item 226, as amended) and art. 24d sec. 2 of the Corporate Income Tax Act of 15 February 1992 (consolidated text: Journal of Laws of 2023, item 2805, as amended) indicate copyrights to computer programs as qualified IP, in practice questions arise as to whether each program, regardless of the degree of innovation, meets these criteria. For example, whether a program modified only in terms of the user interface can be considered an extension of qualified IP.

2. Detailed record keeping requirement and business practice

Taxpayers are obliged to keep detailed accounting records that enable the separation of income from eligible IP.

In practice, maintaining such records can be difficult, especially for small businesses or sole proprietorships where research and development activities are not separated in the accounting systems.

Additionally, the lack of clear guidelines as to the form of record-keeping may lead to the denial of the right to relief by tax authorities in the event of disputed interpretations.

3. Verification of contracts by tax authorities

The tax authorities are increasingly analyzing B2B contracts, pointing out cases in which the cooperation of a programmer with a contractor resembles an employment relationship. In such situations, the authorities may question the application of the IP Box relief, pointing to the lack of actual economic activity of the taxpayer.

3.2 Examples of controversy

In recent years, individual interpretations of tax authorities and rulings of administrative courts indicate different approaches to the application of IP Box relief. Analysis of such cases shows the scale of interpretation problems.

1. Exclusions and Documentation Disputes

In one of the interpretations, the Director of the National Revenue Information stated that the programmer’s activity, which consists only of executing orders for the client, does not meet the requirements of research and development activity. Therefore, income from this activity cannot benefit from the IP Box relief.

In another case, the taxpayer was deprived of the right to relief due to the lack of separate records of costs related to qualified IP. Despite documenting income, the lack of detailed accounting records was considered an obstacle to using the preferences.

2. Differences in the approach to the definition of research and development activities

Tax authorities sometimes interpret R&D activity in a restrictive way, requiring it to be focused solely on projects characterized by a high degree of innovation. Such an interpretation excludes many taxpayers, especially those in the IT sector, where software development often involves incremental product improvements.

3. Cross-checks of contractors:

As part of the inspection, tax authorities check the documentation of the taxpayer’s contractor to verify whether copyrights were transferred and whether income from qualified IP was properly separated. Failure to do so in the documentation may result in denial of the right to relief.

4. Cost Problems in the Nexus Index:

Taxpayers often make mistakes when documenting eligible costs, which can lead to incorrect calculation of the nexus indicator. This is one of the most common reasons for tax authorities to question the correctness of the IP Box application.

3.3 Foreign contractors and IP Box

IP Box relief is also a challenge in the case of cooperation with foreign contractors, which is particularly important for Polish programmers operating on the global market. These problems result from differences in tax systems and international regulations.

1. Complications in tax settlements

- Polish taxpayers using IP Box may encounter difficulties in reconciling the status of income from qualified IP with the tax regulations of the countries in which their foreign contractors operate.

- For example, contracts concluded with entities from third countries may require adjustments to the income structure to avoid double taxation.

2. The risk of double taxation and international regulations

- Poland is a party to the MLI Convention (Multilateral Instrument to Modify Bilateral Tax Treaties), which aims to counteract double taxation and tax abuse. However, the application of the convention in the case of income from qualified IP can be complicated, especially in a situation where different countries define tax relief for innovative activities differently.

- In practice, this may lead to the need to renegotiate contracts with foreign clients or obtain additional tax interpretations, which increases the costs of tax services.

3. Experts also point out the problem of transferring technologies created by Polish programmers to foreign companies. It is worth considering mechanisms supporting IP licensing by Polish entrepreneurs, which could contribute to greater retention of innovation effects in the country.

4. The importance of IP Box for the Polish economy and IT industry

4.1 The role of IP Box relief in the development of the IT sector

Data from the Ministry of Finance from 2023 show that the IP Box relief was chosen by over 7,000 taxpayers, most of whom were programmers running sole proprietorships. The increase in the popularity of the relief among this group shows its importance for the development of the IT sector.

Poland has been strengthening its position as a center for IT outsourcing for many years, offering qualified specialists and competitive labor costs compared to other European Union countries. The introduction of the IP Box tax relief in 2019 contributed to increased interest in Polish specialists in programming and creating innovative technological solutions.

1. Importance for Developers

The IP Box relief allows programmers and IT companies to reduce the effective taxation of income to 5%, which is particularly beneficial for individuals running a sole proprietorship. Thanks to this, programmers have greater opportunities to invest in the development of their own projects or improve their qualifications.

2. Impact on the IT industry

- IT activity, as one of the key industries using IP Box, is seeing an increase in the number of enterprises and individual creators who decide to register their business in Poland.

- Programmers and IT companies particularly value the relief for its flexibility and the ability to adapt to various business models, such as cooperation with foreign contractors or the implementation of large-scale research and development projects.

4.2 Poland’s competitiveness compared to other countries

The IP Box relief plays a key role in building Poland’s competitiveness in the international economic arena. The preferential tax rate of 5% is a significant incentive for foreign investors and domestic companies developing innovative technologies.

1. Attractiveness for foreign investors

Poland, as a country with a well-developed IT sector and technological background, is becoming more attractive to investors from the technology industry. The IP Box tax relief encourages international corporations to relocate their research and development centers to Poland, which increases the number of high-paid jobs and raises the level of investment in IT infrastructure.

2. Comparison with solutions in other countries

The Polish IP Box relief competes with similar mechanisms used in other countries, such as:

- France: The preferential tax rate is 10% and mainly applies to patents and innovations in the pharmaceutical and technology industries.

- Netherlands: Applies the Innovation Box, where income from qualifying IP is taxed at 7%.

- United Kingdom: Patent Box offers a preferential rate of 10% on income from patents and other innovations registered in the UK.

Poland stands out among these countries with one of the lowest tax rates (5%), which attracts special attention from small and medium-sized enterprises and individual innovators. At the same time, simplified administrative procedures make the relief available not only to large corporations, but also to smaller business entities.

5. Conclusion

The IP Box relief is an important element of the Polish tax system, aimed at supporting innovation and research and development activities. Thanks to the preferential tax rate of 5%, Polish entrepreneurs, especially from the IT sector, can develop their projects and compete on the international market. IP Box is both a chance to attract foreign investors and a challenge related to the need for precise regulations and the elimination of interpretation controversies.

The planned changes to the regulations, aimed at tightening the relief and simplifying its application, are crucial for the future of the IP Box. Solving existing problems, such as ambiguities in the definition of qualified rights or documentation requirements, will increase taxpayers’ confidence in this preference and improve its effectiveness as a tool supporting innovation.

For taxpayers, especially programmers and companies using the IP Box relief, it is important to accurately document research and development activities and maintain detailed accounting records, in accordance with applicable regulations. It is also worth monitoring legislative and interpretational changes in order to fully use the potential of the relief and avoid the risk of disputes with tax authorities.

Poland, competing on the international market, should continue to develop IP Box as a tool supporting innovative activity, while taking into account the needs of taxpayers and the requirements of international tax standards. Constant monitoring of the effects of the relief and current updating of regulations will be key to the further development of this solution.