publication date: December 7, 2022

KIELTYKA GLADKOWSKI was pleased to participate in the first event of the series ‘Energy Efficient Networks’ taking place on December 7, 2022 organised by Tech-UK & Capapult CSA.

This was first of five roundtables devoted to energy efficient networks.

Co-Chair Dr Andy G Sellars introduced relevant questions to identify priorities for future research and innovation, mostly in respect of technologies and architectures that will affect energy requirements of future telecom networks.

Dr. Micheal Short of UK Department for International Trade Chief Scientific Adviser discussed the questions of considerable increase of consumption of mobile networks power and options of reduction of energy consumption. The most important options are:

More

publication date: December 5, 2022

Polish draft of the PEPP statute

On March 22, 2022, the deadline for the implementation of the EU Regulation 2019/1238 on PEPP expired. The draft of the Polish act itself was created at the end of 2020. However, in this case, most European Union countries act sluggishly and have still not implemented the content of the regulation into their legal systems. The only example of implementing this regulation is Slovakia and the fintech headquartered there Finax.

Purpose of the PEPP

The main objective of this product is to create such a voluntary pension product that will be used throughout the European Union. The Union is aware that, due to the difficult demographic situation, Member States will provide pensions in such amounts that will not allow for a peaceful, safe and, above all, dignified life after many years of hard work. For example, in Poland, the amount of pensions of current 30- and 40-year-olds is estimated at only 25% of their current salary. Suggested by the EU, it is to build self-awareness of citizens regarding saving. It is also an incentive to take better care of your finances and manage your household budget by increasing your retirement savings.

More

publication date: December 5, 2022

FTX Crypto Exchange

It is one of the largest cryptocurrency exchanges in the world. In January 2022, it was valued at $32 billion. However, in a fairly short time, it significantly lost its value. What were the reasons for this?

It all started with the information published on November 2, 2022 by CoinDesk

(link to the article: https://www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance -sheet/ ). It was revealed in the content of this article that Alameda Research (another company founded by the founder of FTX) is heavily dependent on FTT – a token issued by this exchange. In view of this balance sheet, it was realized that it was not as expected. Previously, FTX was presented as a professional, very advanced and successful operation. After this article, this opinion turned the other way to the disadvantage of this exchange and its management.

More

publication date: December 5, 2022

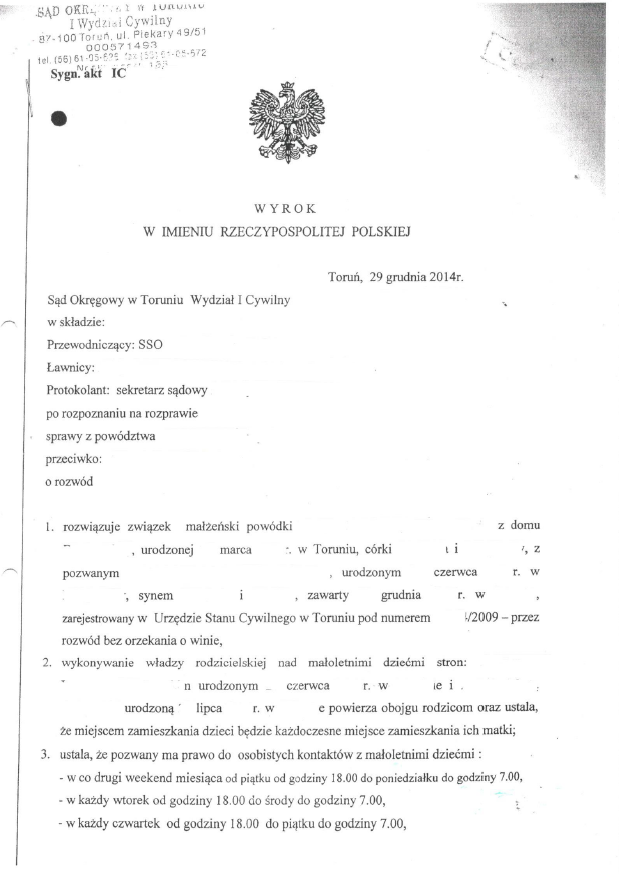

The form of the Polish divorce judgment contains its permanent scheme.

First of all, the document contains its universal elements such as:

– case number;

– national emblem;

– the phrase: “JUDGMENT ON BEHALF OF THE REPUBLIC OF POLAND”;

– the date of the judgment;

– designation of the court and the composition of the court and the recording clerk;

– designation of persons who are divorcing and on whose initiative the divorce case is made;

– a clear indication that the judgment is the resolution of a COURT CASE FOR DIVORCE.

Secondly, the so-called operative part of the judgment, i.e. the substantive decision by the court about the fate of a given family, i.e.:

More

publication date: November 29, 2022

Scientific and technical research

Undoubtedly, scientific and technical cooperation is one of the most important issues

in the development process. Research in this area allows for further development , to a greater or lesser extent, of the whole society, even in the field of exact sciences, such as biology, as exemplified by the development of COVID-19 vaccines.

The aforementioned research may be based on the smooth cooperation of many countries, organizations, such as the European Union, which, however, under the Lisbon Treaty , which gives it legal personality, can be treated as a state, i.e. in the same way as Poland or the United States, whose scientific and technical cooperation is based on, among others Agreement between the Government of the Republic of Poland and the Government of the United States of America on scientific and technological cooperation, signed in Washington on April 23, 2018.

The most important rules

More