Patents Cruciality for Super Generic Medicines

Publication date: November 29, 2024

According to Food and Drug Administration (FDA), a ‘generic drug’ is the same as a brand name drug in many aspects such as dosage, safety, strength, how it is taken, quality, performance, and intended use. On the other hand, the term supergeneric is applied to the development process for small molecule drugs which represent new therapeutic entities which demonstrate an improvement in either product delivery, design or through the application of a more efficient manufacturing process.

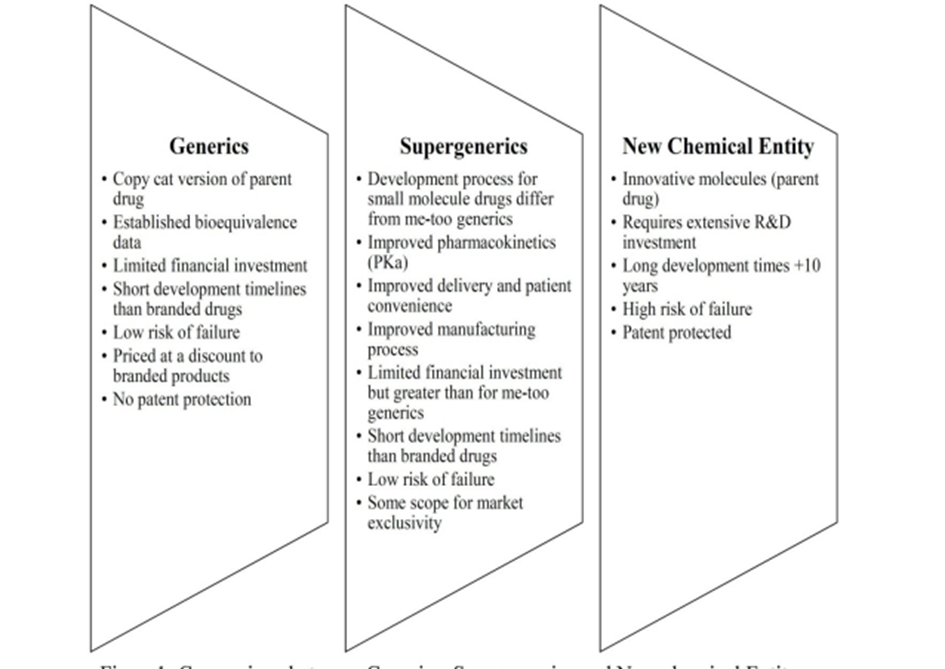

The comparison between generics, super generics, and new chemical entities is shown in the figure below. If such a product is launched by the originator it is considered as a ‘life cycle management’ or ‘brand extension’. If it is launched by a generic company, then such a product is called ‘super generics’.

There are many super generic types depending on their application and innovation, such as:

1. Combination products of patent expired drugs.

2. Products demonstrating therapeutic differentiation from mono-therapies.

3. New dosage forms of off-patent drug substances.

4. Altering pharmacokinetic profiles.

5. Enhanced bioavailability and dose reduction.

Super Generics as promising market

The super generics global market is estimated to reach the anticipated market value of USD 413 billion by 2033 while expanding its global space at a promising CAGR of 7.2% (2023 to 2033). The market holds a revenue of USD 205 billion in 2023.

In Europe, the market was valued at USD 11.4 billion in 2022 and is expected to reach USD 14.2 billion by 2033. It is estimated to surge at a CAGR of close to 2.0% over the forecast period from 2023 to 2033. The anti-diabetic segment held 13.3% in terms of value share and topped Europe in the drug class category in 2022.

The market’s growth prospects as an outcome of the growing demand for alternative medicine and medically advanced companies increasing their research and development programs to add more value to the generics. ultimately helps the end user, the patient, apart from the quality drugs manufactured for a specific disease. The super generic helps the patient in reviving soon and smoothly.

Moreover, the growing geriatric population and dependence on alternate and generic medicines are increasing daily while governments worldwide are working hard to make generic medication available for end users.

Many super generic products stand in the global market and here are some examples:

1) Abraxane

a super generic form of Taxol (FDA, 2005), which uses albumin to deliver the chemotherapy, not Cremophor, and so avoids hypersensitivity and claims a greater tumor response rate than Taxol. The drug Abraxane (nanoparticle albumin-bound paclitaxel) uses the approach of coating Taxol with albumin to reduce the side effects associated with standard Taxol (paclitaxel), making it possible to give it without steroids.

2) Subacap

a super generic of the conventional itraconazole formulation used to treat fungal infections. Mayne Pharma Subacap provides enhancements to patients and prescribers with reduced inter- and intra-patient variability and therefore a more predictable clinical response enabling a reduction in active drug quantity to deliver therapeutic blood levels. Itraconazole is one of the broadest spectrum antifungal drugs on the market and can be used to treat both superficial fungal infections such as onychomycosis (nail infection) and systemic fungal infections such as histoplasmosis, aspergillosis and candidiasis which can be life-threatening to immunocompromised patients.

3) Absorica

Ranbaxy Laboratories Limited launched Absorica Capsules in U. S healthcare market, a superior version of (Isotretinoin). Absorica is being prescribed for the treatment of severe recalcitrant nodular acne in patients of the age group of 12 years and above. The drug has a total market size of $1 billion (at the price of Absorica). Absorica, a super generic version of isotretinoin that is bioequivalent to the Accutane capsule when both are taken with a high-fat meal. But the former shows a better bioavailability than the latter when taken fasted.

4) Dymista

Cipla & Meda, the two generic players, signed the MOU and came into collaboration to get commercialization rights for Dymista, used for seasonal allergic rhinitis. Dymista (Azelastine hydrochloride and fluticasone propionate) is a novel formulation of Azelastine Hydrochloride, an antihistamine, and Fluticasone Propionate; a corticosteroid approved by the US FDA in May 2012.

Dymista is being marketed as a sprayed suspension designed for intranasal administration. The recommended dose of Dymista is one spray per nostril twice daily. Dymista has consistently shown speeder and more complete symptom relief than standard treatment in the US and was approved in the US in May 2012 and in Europe in January 2013.

5) Ambil and Doxisome

Ambil is the liposomal encapsulate formulation of Amphotericin B & Doxisome is the liposomal formulation of Doxorubicin. Both formulations come under the super generic category and can register marked improvement in patients’ compliance by reducing side effects and providing an effective dosage.

The Role of Patents in Pharmaceutical Innovation

Patents serve as a cornerstone of pharmaceutical innovation by offering legal protection that encourages investment in research and development (R&D). This is particularly critical in the pharmaceutical sector, where the development of a new drug—or an enhanced version, such as a super generic—requires substantial financial and time commitments. By granting innovators exclusive rights for a limited period (typically 20 years from filing), patents ensure a temporary monopoly, allowing companies to recoup their investments and reinvest in future advancements.

Pharmaceutical innovation thrives on addressing unmet medical needs or improving existing therapies. Super generics exemplify this innovation, offering improved bioavailability, novel delivery mechanisms, or better therapeutic outcomes compared to their traditional generic counterparts. For instance, drugs like Abraxane and Absorica demonstrate how patents incentivize the development of enhancements that provide significant clinical and commercial benefits.

Moreover, the costs of clinical trials and bioequivalence studies for super generics, although lower than for new chemical entities, remain substantial. Patents help justify these expenses by safeguarding the resulting innovations from immediate replication by competitors. This assurance is especially critical for companies developing unique formulations, such as controlled-release systems or liposomal encapsulations, which require significant technical expertise.

Finally, patents contribute to broader pharmaceutical progress by fostering collaborations and licensing agreements. Innovators can leverage their patent portfolios to attract partners or licensees, as seen in the case of Dymista, where Cipla and Meda used the patented dual-action formulation to mutual benefit. In this way, patents not only protect individual inventions but also promote knowledge-sharing and investment across the industry.

Challenges Faced by Super Generic Manufacturers

Super generic manufacturers face unique challenges in bringing their products to market. Unlike traditional generics, which largely avoid the complexities of innovation, super generics require careful planning including navigating existing patents, meeting stricter requirements, and evaluating the risk of legal challenges.

Navigating Existing Patents

One of the biggest hurdles is understanding and working around the patents that protect active pharmaceutical ingredients (APIs) and formulations. Developers of super generics must conduct thorough Freedom to Operate (FTO) analyses to ensure their products don’t infringe any existing patents. This involves identifying gaps in the patent landscape where improvements can be made legally. However, this process is complex, time-consuming, and can lead to unintentional disputes if overlooked. Without careful patent research, manufacturers risk expensive litigation or delays in product approval.

Meeting Stricter Requirements

Super generics are held to much higher standards than standard generics. While traditional generics only need to prove bioequivalence to the originator drug, super generics must demonstrate the added value of their improvements. This often means conducting additional lab tests, stability studies, and even clinical trials to prove enhanced efficacy, safety, or delivery mechanisms. These extra requirements come with significant costs, which can strain smaller companies that lack the resources of larger pharmaceutical firms.

Risk of Legal Challenges

Despite efforts to innovate within legal boundaries, super generic manufacturers often face litigation from originator companies. These companies may argue that the innovations in super generics are too similar to their patented products, even if the patents on the original API have expired. Lawsuits can be financially and reputationally damaging, and defending against them requires substantial legal expertise. For smaller players in the industry, these challenges can be a major deterrent to innovation.

Strategic Use of Patents by Super Generic Manufacturers

Super generic manufacturers employ strategic patenting practices to attain a competitive edge in the pharmaceutical market. Unlike traditional generics, which replicate off-patent drugs without modifications, super generics rely on innovations that must be carefully protected to ensure market success. Many strategies can be conducted after patent granting, the main strategies are:

1) Securing Secondary Patents

While the primary patent on the active pharmaceutical ingredient (API) may have expired, super generic manufacturers often file secondary patents for:

- Formulations: Novel delivery mechanisms or dosage forms, such as the nanoparticle-based formulation of Abraxane.

- Processes: Improved or more cost-effective manufacturing methods, like those used for Subacap.

- Combination Therapies: Unique combinations of APIs, as in Dymista.

These secondary patents extend exclusivity and make it harder for competitors to introduce bioequivalent products.

2) Building Patent Thickets

A “patent thicket” involves filing multiple overlapping patents around a single product to create a robust barrier against generic competition. For example, a super generic manufacturer might patent various aspects of a drug, including its formulation, delivery method, and manufacturing process. This strategy complicates the pathway for competitors seeking to launch competing products.

3) Defensive Patenting

Super generic manufacturers also use defensive patenting to block rivals from entering the market. By filing patents on foreseeable modifications or improvements, they limit the ability of competitors to innovate in the same space.

4) Licensing and Revenue Generation

Patents are valuable assets that can generate revenue through licensing agreements. For instance, the partnership between Cipla and Meda on Dymista illustrates how super generic manufacturers can monetize their innovations by licensing patented technologies to larger pharmaceutical companies.

5) Supporting Lifecycle Management

For originator companies venturing into super generics, patents serve as a vital tool for lifecycle management. By patenting improved versions of their original products, they can sustain revenue streams even after the primary patent expires. This approach is particularly evident in products like Ambil and Doxisome, which use patented liposomal formulations to enhance patient outcomes.

6) Mitigating Market Risks

Patents also serve as a risk mitigation tool. They provide legal grounds for challenging infringing competitors and ensure that investments in product development are not undermined by immediate copycat products.

Summary and Conclusion

Super generic medicines are a step beyond traditional generics, offering improved formulations, better delivery methods, and enhanced therapeutic effects. They address unmet medical needs while remaining cost-effective, as seen in examples like Abraxane and Dymista. With the global market projected to double by 2033, super generics are gaining traction due to rising healthcare needs and government support for affordable medicine.

Patents are crucial for protecting these innovations and ensuring companies can recover their investments. Strategies like securing secondary patents and forming licensing partnerships help manufacturers stay competitive. However, navigating existing patents, meeting stricter regulations, and avoiding legal disputes pose significant challenges.

In conclusion, super generics combine innovation with accessibility, filling an important niche in the pharmaceutical landscape. With thoughtful patent strategies and ongoing innovation, they are poised to make a lasting impact on global healthcare.

References

1. Suresh Garud. “SUPERGENERICS – A COST SAVING PARADIGM.” International Journal of Pharmaceutical Research & Development 5 (January 2014).

2. “Super Generics Market Outlook (2023 to 2033).” Future Market Insights, July 2023. https://www.futuremarketinsights.com/reports/super-generics-market. Accessed on 20 November 2024.

3.“Europe Super Generics Industry Outlook from 2023 to 2033.” Future Market Insights, October 2023. https://www.futuremarketinsights.com/reports/super-generics-industry-analysis-in-europe. Accessed on 20 November 2024

4.LOKESH KUMAR. “SUPER GENERICS / IMPROVED THERAPEUTIC ENTITIES: AN APPROACH TO FULFIL UNMET MEDICAL NEEDS AND EXTENDING MARKET EXCLUSIVITY OF GENERIC MEDICINES” International Journal of Pharmaceutical Science 7 (November 2014)

5. Barei, Fereshteh, Claude Le Pen, and Steven Simoens. “The Generic Pharmaceutical Industry: Moving beyond Incremental Innovation towards Re-Innovation.” Generics and Biosimilars Initiative Journal 2, no. 1 (March 15, 2013).

6. ABG Intellectual Property. “Freedom to Operate Reports (FTO). https://abg-ip.com/freedom-to-operate-reports/. Accessed on 25 November 2024.

7. Patents. “Frequently Asked Questions: Patents,” https://www.wipo.int/web/patents/faq_patents. Accessed on 25 November 2024.